Plate is expected to usher in reversal opportunity in April

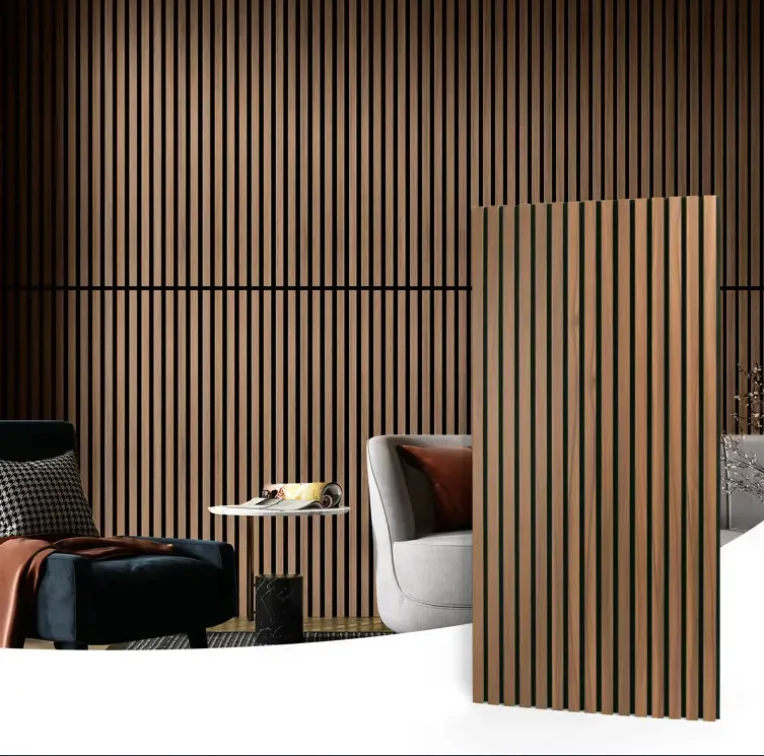

Interior Aku panel Wooden Slat Acoustic Panels Sound Proof Slated Wood for Hotel Application Wall Decoration Shandong Zeen Decoration Material Co., Ltd. , https://www.zeendecor.com

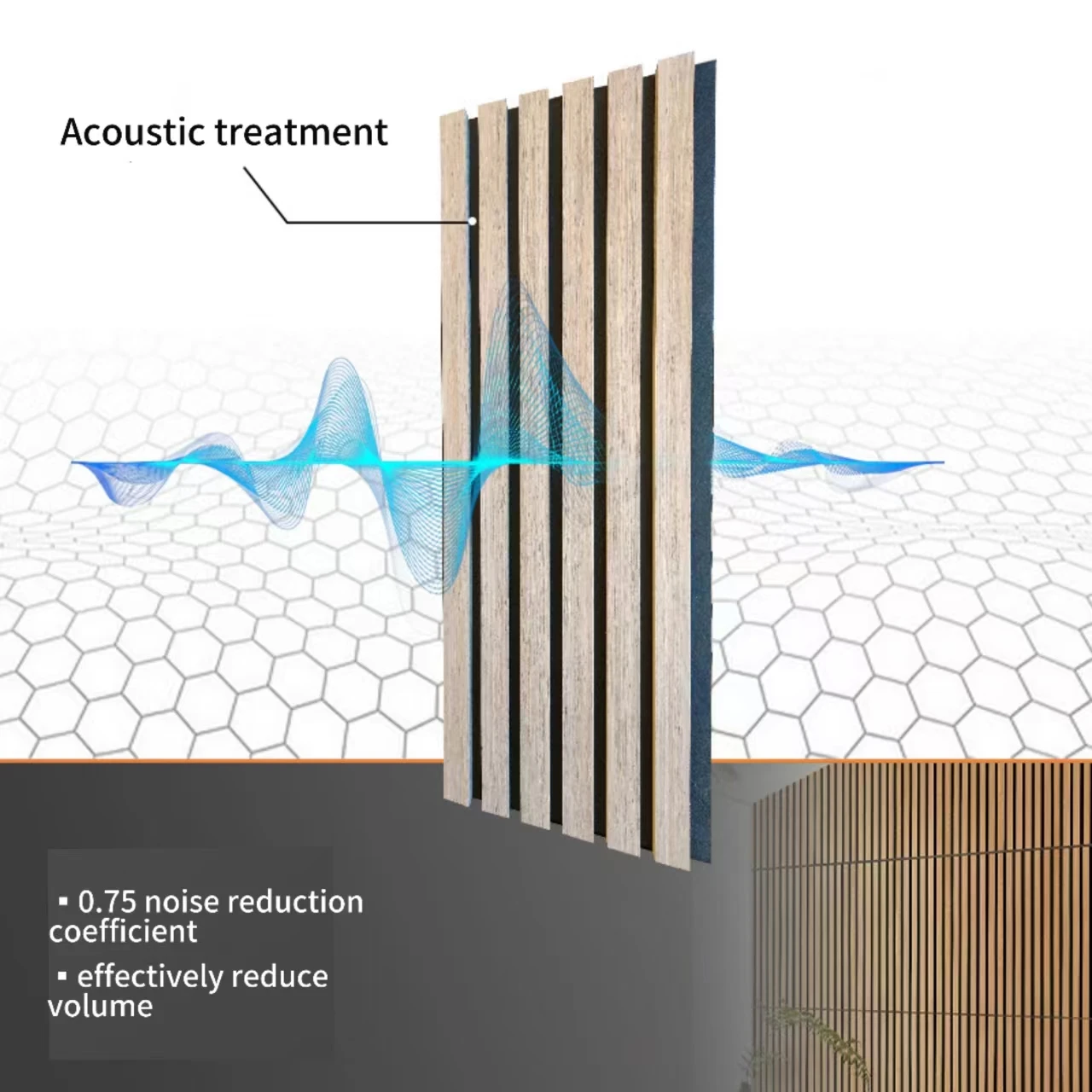

Our sound-absorbing panel factory is a leading producer of high-quality sound control products. Our panels are designed to reduce sound transmission and reflection within commercial, industrial and residential environments. With a focus on innovation and technology, our factory employs state-of-the-art production techniques to manufacture sound-absorbing panels that meet the highest standards of acoustical performance.